Calendar Put Spread - Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. A long calendar spread is a good strategy to use. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web if a trader is bearish, they would buy a calendar put spread. Web learn how to create and manage a long calendar spread with puts, a strategy that profits from neutral or directional stock price action near the strike. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

A long calendar spread is a good strategy to use. Web if a trader is bearish, they would buy a calendar put spread. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web learn how to create and manage a long calendar spread with puts, a.

Calendar Spread Put Sena Xylina

Web learn how to create and manage a long calendar spread with puts, a strategy that profits from neutral or directional stock price action near the strike. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. Web the complex options trading strategy, known as the put calendar spread, is.

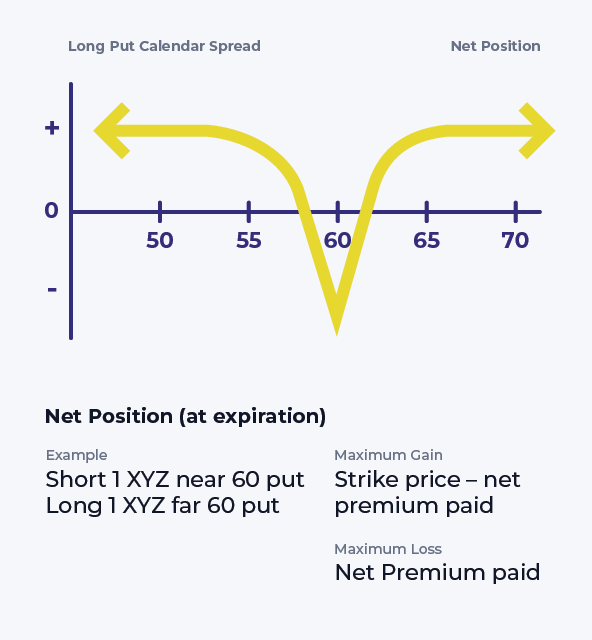

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. A.

Put Calendar Spread

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web if a trader is bearish, they would buy a calendar put spread. Web a long calendar put spread.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web learn how to create and manage a long calendar spread with puts, a strategy that profits from neutral or directional stock price action near the strike. Web if a trader is bearish, they would buy a calendar put spread. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of..

Calendar Put Spread Options Edge

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the.

Long Calendar Spread with Puts Strategy With Example

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. A long calendar spread is a good strategy to use. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web the complex options trading strategy, known as the put calendar spread,.

STZ — Diagonal Calendar Put Spread? for NYSESTZ by OptionsAddicts

A long calendar spread is a good strategy to use. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web the calendar spread options strategy is a market.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web if a trader is bearish, they would buy a calendar put spread. Web the complex options.

Bearish Put Calendar Spread Option Strategy Guide

Web if a trader is bearish, they would buy a calendar put spread. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. A long calendar spread is a good strategy to use. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web if a trader is bearish, they would buy a calendar put spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. A long calendar spread is a good strategy to use. Web learn how to create and manage a long calendar spread with puts, a strategy that profits from neutral or directional stock price action near the strike.

Web The Complex Options Trading Strategy, Known As The Put Calendar Spread, Is A Type Of Calendar Spread That Seizes Opportunities.

Web the calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of. A long calendar spread is a good strategy to use. Web learn how to create and manage a long calendar spread with puts, a strategy that profits from neutral or directional stock price action near the strike. Web if a trader is bearish, they would buy a calendar put spread.

Web A Calendar Spread Is An Options Or Futures Strategy Where An Investor Simultaneously Enters Long And Short.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)